Introduction

Laneways are one of the characteristic urban forms of Toronto—a line of garage doors emblazoned with street art is a quintessentially Torontonian view. They grant the city’s older, lower-density neighbourhoods an unexpected hipster credibility, while making it a little easier for cars to have a place to live in the city.

Soon, these laneways might make it a little easier for people to live affordably in the city, too. After years in development, the city adopted a set of changes to its zoning by-laws in August 2018 which will allow for the as-of-right construction of laneway housing within the boundaries of Toronto and East York. Under the new structure—which the city cutely named “Changing Lanes”—homeowners in the two boroughs whose properties abut to laneways may be eligible to construct what the city calls “laneway suites.” By the city’s math, almost 34,000 lots might be eligible (per page 14 of the city’s planning document).

To translate from Torontonian into more common housing parlance, a laneway suite is a backyard accessory dwelling unit (or ADU). Toronto is late to the ADU party, but has sauntered through the door to find itself in good company—among cities with rental affordability nightmares. Notably, Vancouver has beaten a path for other cities to follow: in 2009, they legalized laneway houses as part of an attempt to increase the stock of affordable rental units inside the city. ADUs are smaller, after all, so their nominal rents will be lower than a full house at the same rent per square foot. Since their policies were changed, 3,300 laneway houses have been built. A city survey found that 85% of occupants are renters, with 81% paying $2,000 or less per month in rent—in a city with an average one-bedroom rent of $2,110 per month.

The only more expensive city to rent a one-bedroom apartment in Canada, as it happens, is Toronto. In November 2018, average rent for a one-bedroom apartment was $2,220; in this year’s mayoral election, housing affordability was the central issue. While housing production is no issue in Toronto, which had over 60,000 condo units under construction in May 2018, meeting housing needs for lower-income people—especially in the city’s expensive core of transit-accessible neighbourhoods—has proven to be challenging. Advocates for laneway suites see them as a part of a solution to this crisis, by building new units in the inner neighbourhoods of the city where single-family houses backing onto laneways predominate.

Research Questions

With the enabling zoning changes in place, the question now is how much of an impact laneway suites can have on Toronto’s rental affordability crisis. Four critical questions arise from this problem:

- How many properties are truly eligible to host a laneway suite?

- How are they distributed across the city’s core neighbourhoods?

- How many laneway suites will be financially viable for homeowners to construct?

- Will those that are financially viable be affordable for renters priced out of the market today?

A secondary aim of this project has been to generate an informational resource for Toronto homeowners curious about laneway suites, allowing them to assess the potential rents and breakeven periods for a suite on their property.

My analysis has been performed in consultation with Toronto’s city planning department and Paul Waddell, Professor of City Planning at UC Berkeley. I have relied on publicly-available datasets from Toronto’s Open Data Catalogue to assess the number and distribution of eligible properties, and an archive of 2018 Craigslist rental listings in the city assembled by Prof. Waddell to assess potential financial viability.

Mapping the Potential of Laneway Suites

In the interest of getting to the good part early—who doesn’t want to eat dessert first?—I will start with two maps showcasing the impact laneway suites could have on Toronto’s rental affordability crisis. (I recommend viewing them both in full screen to navigate them more effectively.)

Note: I present the underlying analyses in the section following these maps, and explain the methodology used to understand which properties are eligible and how financially feasible their laneway suites might be in my final section.

First up: the potential impact on Toronto’s central neighbourhoods. This map shows the 37 neighbourhoods which contain at least one property eligible to host a laneway suite. It is coloured by the potential percent increase in rental unit stock from laneway suites; darker neighbourhoods have the largest potential increases. By configuring the included widgets, or clicking on a neighbourhood, you can compare this view with several neighbourhood-level analyses from the 2016 census.

UPDATE, 4/25/2022: CARTO, the company which hosted this map, insisted that I had to pay $299 a month to keep it online. While I work through the process to find a new map host, I have embedded a snippet of the map as a video so you can get a feel for it.

What becomes immediately clear is that laneway suites will have little to no impact on Toronto’s downtown (mostly within the Bay Street Corridor, Church-Yonge Corridor, and Waterfront Communities-The Islands neighbourhoods). Instead, this new housing modality could mean massive increases in rental stock in the lower-density neighbourhoods to the east and west of the core. In the west end, Trinity-Bellwoods—which Vogue has called one of the world’s coolest neighbourhoods—could see an 80% growth in rental units with the addition of laneway suites. To the east, South Riverdale—home to Leslieville, my old stomping grounds, which the New York Times acclaimed as the city’s coolest neighbourhood (take that, west end!)—rental stock could grow by 72%. I’ll get into more detail about the potential impacts of laneway suites at the neighbourhood level in my analysis section.

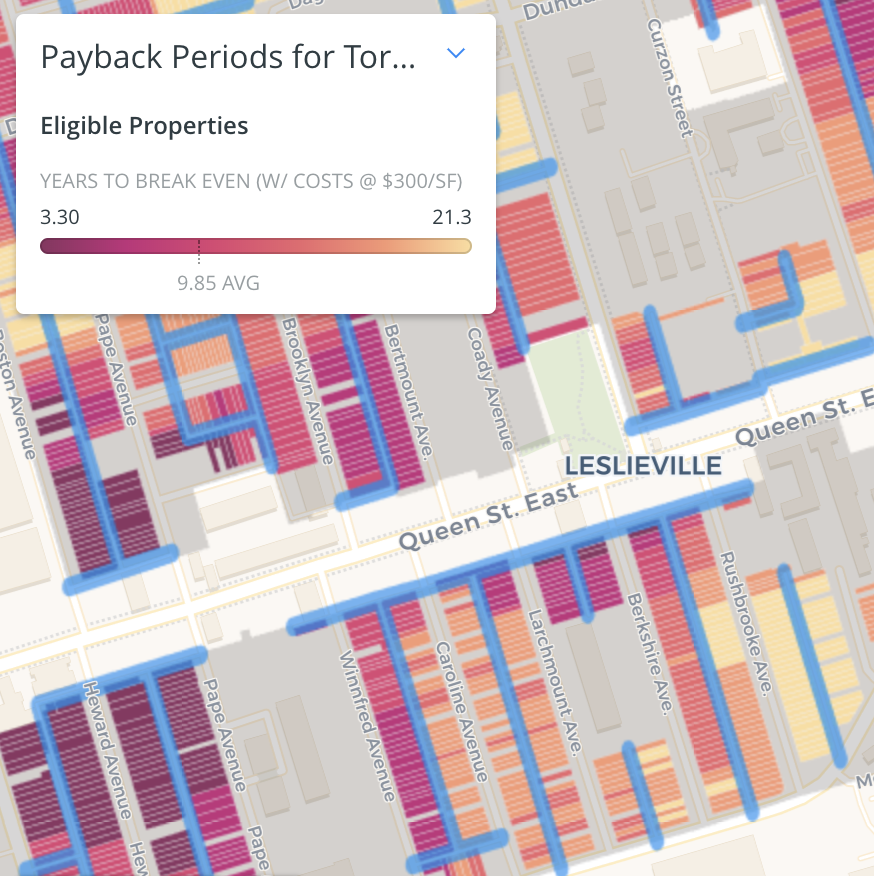

Second: as I mentioned, a goal of this project has been to produce an informative tool for homeowners curious about building a laneway suite on their properties. The map below shows the areas eligible for laneway suites in grey, and the laneways themselves in blue. Layered atop those are the properties eligible for laneway suites, coloured by the time a laneway suite would take to break even at current rental prices. The colours range from dark purple, with the shortest payback periods, to pale yellow, with the longest. I have also included widgets to filter the laneway suites by potential rents for differently-sized apartments.

UPDATE, 4/25/2022: CARTO, the company which hosted this map, insisted that I had to pay $299 a month to keep it online. While I work through the process to find a new map host, I have embedded a snippet of the map as a video so you can get a feel for it.

While this map is difficult to summarize, it suggests that a significant number of properties are located in areas with relatively lower rent rates. With Toronto’s one-bedroom rents averaging $2,220 at the time of writing, rents and the small size of laneway suites come together favourably. Roughly 8,000 potential one-bedroom suites might attract rents of $1,300 or less, with another 16,000 between $1,300 and $1,800. However, financing barriers will be significant, with payback periods averaging 13 years for the 8,000 lowest-rent units, and 10 years for the 16,000 other more affordable suites. I will explore the potential impact of these financial challenges further in my analysis section.

Also worth noting—while the vast majority of the properties shown are almost certainly eligible to build a laneway suite, there may be a small number of false positives that do not have adequate lot frontage onto a laneway. If any homeowner with a lot on a laneway is reading this, sees their lot in the map, and wants to build a laneway unit: grab a tape measure and make sure your property has AT LEAST 3 METRES of frontage on the laneway. Due to some limitations in the analytical tools I used, I was not able to accurately filter properties by frontage. Even without that, I believe this is a highly accurate picture, as only a small number of corner properties would likely have less than 3 metres of frontage on a laneway. I expand on the reasons why I was unable to calculate frontage in my methodology section.

Analyzing Affordability Impacts

To dig into the affordability impacts of laneway suites at the neighbourhood level, I’ve used Plotly, a dynamic, useful graphing tool with a wide range of display options. The following charts are running off Plotly’s freely available public cloud, and were built in Python.

First, I wanted to dig into the distribution of estimated rent rates for the 32,000 eligible properties across the city. As noted above, Toronto’s median rent for a one-bedroom apartment in the city is $2,220. The chart below—a “violin” chart—shows the distribution of rents across the laneway suites in each neighbourhood with eligible properties. Hovering your mouse over a given shape will show you the details of the distribution of rents in its neighbourhood. (Admittedly, the chart is a bit overwhelming—plenty of data for plenty of neighbourhoods—but drag your cursor to select some of the colourful shapes and you’ll see a zoomed-in view.) The box in the middle of each shape shows the middle 50% of rents for the neighbourhood’s properties.

As you explore the data, it becomes clear that the majority of theoretical laneway suites would likely see rents lower than Toronto’s median—a good sign that laneway suites distribute themselves in parts of the city which might be a little lower than the average rent, despite their relative closeness to the urban core. That’s a piece of good news for affordability.

Financial feasibility, however, is likely to be the main obstacle to getting these laneway suites built. Exploring the map of properties above makes it clear that many of the most affordable properties have the longest payback periods. The following chart is a cumulative histogram of eligible properties by payback period; the height of the blue area indicates the number of properties with a payback period no longer than the years from the left of the x-axis.

Even still, this is a good news story. At the 10-year mark, ~18.3K properties (over half of the total) would have broken even, based on a simple calculation of unchanging rents and cash financing for construction. Securing financing, and making financial products available to interested homeowners, will be a critical part of realizing the incremental housing units these laneway suites can provide the city. Even adding the ~2.7K units which would break even by year 7 would make a significant difference in a city with plenty of housing construction but little in the way of new rental units.

There are a few other useful ways to think about how future laneway suites are distributed through the city. Below is a pie chart, segmented by neighbourhood, with the percentages indicating the percent of total eligible properties in a given area. Hovering over the segments allows you to see the neighbourhood’s name and the number of eligible properties.

This shows that almost 40% of all eligible properties are in one of four neighbourhoods. Dovercourt-Wallace Emerson-Junction, on the city’s west side, is home to the largest number of eligible properties of any of the city’s neighbourhoods; South Riverdale, my old home in the east end, has the second largest. Palmerston-Little Italy and the adjoining Trinity-Bellwoods neighbourhood—two of the city’s hottest real estate markets, just west of the core—round out the top four.

But perhaps the most useful way of exploring the degree to which laneway suites address the affordable rental crisis comes down to the degree of impact they could have on each neighbourhood’s rental stock. The chart below shows the percent change in rental stock that adding a laneway suite on each eligible property would have for each neighbourhood—the same view as on the first embedded map.

Interestingly, the top 10 neighbourhoods by degree of impact are very different from the top 10 neighbourhoods by total eligible properties. 4 of the top 10 are in the city’s east end, where homeownership is more common; Trinity-Bellwoods, number 4 by total volume of eligible properties, would see the largest increase in rental units if those suites were built and rented out.

To combine these views, the following (and final) chart shows the distribution of payback periods for the 10 neighbourhoods with the largest potential impact to their rental stock. This is a “box plot”, a similar view to the violin chart above, with a little bit less information about the statistical properties of the distribution.

It shows that Trinity-Bellwoods may be the epicentre of Toronto’s laneway suite revolution. With the largest impact to its rental stock, and the lowest payback periods of the most affected neighbourhoods (thanks to the higher-than-average rents they’d attract), it has the highest potential. As Toronto policymakers devise their planned affordability pilot program for new laneway suites, it would likely be the safest bet as a place to start. And it may hold the key to a denser, more vibrant future for the city’s laneways—helping them go from a unique part of the city’s hipster fabric to a set of places where people of all sorts can make their homes, affordably.

Methodology, Limitations, and Future Research Directions

Generating the datasets explored above relied on a set of open data from the City of Toronto:

- Property boundaries

- Addresses (as centroid points) with property information

- Centreline, with streets labelled by type (including laneways)

- Zoning boundaries

- Toronto community council boundaries

- Neighbourhood boundaries and 2016 census profiles

I also relied on Professor Waddell’s aforementioned set of 2018 Toronto Craigslist rental listings to estimate the financial viability of each property.

I began by thoroughly reviewing Changing Lanes, the city’s strategy document. There are four critical requirements, and one apparently informal (but important) one, for a property to be eligible for a laneway suite:

- It needs to fall under the Toronto and East York Community Council’s jurisdiction. Toronto is a large city composed of boroughs that were administered separately until their amalgamation in the 1990s. One legacy of the old cities is the planning process in the city; so-called community councils map roughly to the old boundaries, and direct planning within them. Changing Lanes is an initiative of the TEYCC, mostly because that’s where the older neighbourhoods with houses backing onto laneways are.

- It needs to sit on R-zoned land. There are a variety of residential zones in the city’s zoning scheme, covered by Zoning By-law 569-2013; R is the most general, with the others dedicated to specific housing modalities (such as medium- or high-density apartments).

- It needs to have at least 3 metres of frontage on a laneway. This is mostly to exclude a small number of properties that have a rear corner on a laneway; most lots in the city are at least 3 metres wide, and laneways mostly run parallel to the street grid.

- A suite’s theoretical entrance must be at most 45 metres away from streets accessible to emergency vehicles. Laneways themselves are not considered accessible in general, with widths being a limitation; most other public streets are fair game.

- This doesn’t actually appear to be a formal requirement, but the property should be a single-family home. Larger properties, or commercial properties which back onto laneways and are otherwise eligible, could conceivably build a laneway suite depending on their specific zoning exceptions and the land use policies they operate under. (In the interest of respecting the spirit of the policy, I focused on properties that appeared to be single-family homes.)

With those requirements in mind, I began downloading and processing the property boundaries data. I am happy to share the python code that underpinned any and all of this analysis for anyone curious—feel free to reach out to me. Here’s the order of operations I followed:

- I identified the city’s R-zoned areas by dissolving them into a single shape, and used an overlay function to limit my focus to the R-zoned areas within the Toronto and East York Community Council’s boundaries.

- For both the citywide property and address point datasets, I applied the TEYCC boundaries, to filter them to the relevant neighbourhoods.

- I then applied the boundaries of the R-zoned areas within TEYCC to the properties and addresses, and joined the resulting datasets to one another. As encoded, the property boundaries are only polygons, with no identifying fields; applying the address point data helped provide context about what was on each lot.

- The address point data includes a “feature code” for each property. Many are not encoded, and listed as “unknown”; the rest, however, are listed specifically. I used these feature codes to identify low-density residential properties, and excluded all other types (save for “unknown” properties, many of which were low-density residential when I overlaid them on a map of the city).

- I then used the city’s centreline data to identify laneways, and joined them to the TEYCC boundaries to limit the scope of my analysis.

- Laneways in the city are by no means standard creatures — they’re a variety of widths, lengths, and shapes. According to the Laneway Project, a Toronto nonprofit focused on using laneways as functional spaces in the city, they can range from 3 to 6 metres wide; I applied a 6-metre buffer to the filtered laneways; smaller buffers didn’t do a good job of capturing houses on laneways’ dead ends, given some discrepancies between the centreline and property datasets.

- I used a spatial join to figure out which properties from the above filtered list abutted to laneways. This resulted in a set of a little over 38,000 properties, including a few thousand that were too large to be single-family houses (such as the sprawling 16-storey Moss Park Apartments complex, which is in an R zone and touches Ramsays Lane).

- I returned to the centreline dataset and filtered it to focus only on streets that emergency vehicles could access—local, arterial, and collector roads. I joined that dataset to the TEYCC boundaries to limit the scope of my analysis, and then applied a 45-metre buffer. Another spatial join to the filtered property data allowed me to eliminate the properties which were somehow inaccessible.

- To solve the issue of too-large properties, I calculated the area of each property and experimented with different quantiles to find the magic number that kept the vast majority of small properties while eliminating the too-large ones. As it happens, there was a pretty big break between the 98th and 99th percentile of areas; eliminating the top 1% of properties did the trick, producing a cleaned dataset of ~32,000 properties. A visual comparison of the two datasets makes me pretty comfortable that few truly-eligible properties were eliminated.

- I had hoped to perform some analysis to identify the amount of frontage each property had on a laneway, but after repeated kernel failures, I turned to QGIS to run an intersection analysis of the laneway buffers and the eligible properties. My aim was to use what I think of as “property tips”—the very ends of the properties—as a basis to run calculations on the side lengths of each property boundary polygon. After letting it run for 10 hours, I generated a shapefile of all the property tips; sadly, in the interim, I searched and failed to find an effective way to calculate the lengths of the edges of each polygon in a large dataset. I made the decision to exclude this filter from my final product.

- This is perhaps the greatest limitation to my analysis—there are clearly properties which corner onto laneways included in this data. However, they appear to be fairly small in number. To manage this, the buffer I applied to the laneways was as narrow as possible—I fiddled with its width until making sure it wasn’t capturing properties that didn’t really touch a laneway—and the fact that the geometry of many of the city’s laneways precludes corner touching.

- With that disappointment, I returned to the area-filtered property dataset as the final set of eligible properties, and moved on to financial feasibility calculations. Professor Waddell’s 2018 Craigslist rental listings for Toronto was the raw dataset; I filtered it to exclude several inaccurate outliers (such as miscategorized sales, room rentals, and parking spots), and was left with about 19,000 listings.

- I started by calculating median rents by neighbourhood. I joined the neighbourhood boundaries to the shapefile of R-zoned areas in Toronto and East York to determine which ones could potentially host laneway suites, and then joined that subset to the rental listing data, leaving about 14,000 relevant data points. Using groupby, I then calculated a 2018 median rent per square foot for each neighbourhood.

- Reviewing the city’s neighbourhood census profiles, a handful of relevant housing cost metrics stood out. I merged those with the above median rents to produce a shapefile with those indicators for each neighbourhood, with room to subsequently add information about the number of laneway suites in each.

- I then turned to the potential rental rates of a laneway suite on each property. I devised a strategy that takes into account the four closest rental listings to a given property. Each listing’s rent per square foot would be assigned a weight equal to the closest listing’s distance divided by the given listing’s distance to the property, and the four rents per square foot would be combined with that weighting factor to calculate the property’s estimated rent. That ensures the closest property receives the most weight, and the other properties receive a weight proportionate to their distance.

- To generate the set of closest rental listings, I needed to perform spatial analysis on two immense datasets, the properties and the rental listings. While there are few spatial analysis tools that leverage python effectively to calculate closest points—especially comparing two large datasets—I found myself using Carto, which did a great job of finding the four closest rental listings to each property quickly and efficiently.

- One choice I made that’s worth noting is that I did not remove any duplicate listings—by which I mean shared coordinates—for two reasons. Having found an apartment on Craigslist, I know that listings are often taken down and put back up if they get stale, which might mean that their rental prices may be higher than the market would genuinely allow. That could skew the rents in the dataset upward. However, removing those points would also eliminate apartment buildings and rented condos sharing addresses, from which multiple apartments might be listed. Given the relatively small number of listings in several areas, particularly the neighbourhoods like South Riverdale with little rental stock today, I felt that it was more prudent to include them to increase sample size.

- A potential limitation of this approach: I did not account for the date of the listing in my analysis, as Carto did not really make it possible to do so. In an ideal world, the issues I outline above would be mitigated by assigning closest points and choosing listings based on recency for any points with the same coordinates (to prevent 5 listings in one apartment building from skewing the data).

- I processed the resulting dataset of the 4 closest rental listings per property, applied my weighting factor, and generated an estimated rent per square foot for each property.

- With estimated rents assigned to each property, I moved on to calculating financial feasibility, with a few simple assumptions:

- I would use 600, 800, and 1,000 sq.ft. as three potential laneway suite sizes, corresponding to 1-, 2-, and 3-bedroom units, multiplied by the property’s estimated rent per sq.ft. to assess potential rent

- I would assume a construction cost of $300 per sq.ft., a conservative estimate informed by this helpful compilation of data by the author of Backdoor Revolution, a recent book on the potential of ADUs

- The primary metric I would evaluate was payback period, since ADUs are typically self-financed; without traditional or mortgage-like financing products, many are built with cash or extracted home equity, so the time to break even is crucial

- With those financial metrics calculated for each property, I created a fork with the centroids of each property and joined that to the neighbourhood dataset. Using a groupby count function, I then determined the potential number of laneway suites per neighbourhood, and compared that figure to the number of rental dwellings and dwellings overall to understand the possible increase in stock laneway units could represent.

- I then exported the two datasets—properties with financial metrics embedded and neighbourhoods with number of laneway suites and median rents—and generated the above maps and analysis.

In the future, a more robust analysis should incorporate a means of assessing frontage lengths, along with a more rigorous way of calculating the nearest rental listings to a given property that incorporates listing date. Using this dataset to produce an application that allows homeowners to test different construction costs and laneway suite sizes, particularly one that includes the design specifications laid out in Changing Lanes, would provide critical information to a homeowner considering building a laneway suite of their own.

Data Sharing

To get your hands on any of the data produced as part of this project, please contact me—my email is my full name (no dots or dashes) at Berkeley, dot E-D-U—and I would be happy to share the underlying spreadsheets and shapefiles.

Acknowledgments

Getting from raw data to the conclusions above has been a challenge, and I’d like to thank a variety of helpers for their support. In Toronto’s city planning department, planner George Pantazis was very helpful as I interpreted the Changing Lanes document, and pointed me toward the correct datasets in the city’s Open Data Catalogue. Professor Waddell, who taught me the Python skills needed to execute this vision, also generously shared the Toronto rental listing dataset he has generated from Craigslist over the past year. Without that, assessing financial viability (and median rents across the city’s neighbourhoods) would likely not have been possible. Arezoo Besharati Zadeh, the GSI who worked with Paul this semester, was a big help as I developed my coding skills and worked through these various conundrums. Plotly’s remarkably simple and customizable software really helped bring the information to life, as did Carto’s mapping platform, and all the many open-source contributors who’ve made all the Python tools I used as great as they are. Thanks, y’all!

Do laneway homes make financial sense? what’s the cost relative to potential rental income?